Capabilities

Multi-Asset

Our multi-asset range offers traditional, balanced strategies and bespoke LDI solutions, alongside innovative, multi-strategy, total return approaches.

Our multi-asset strategies benefit from our deep experience managing long-term solutions and pension products. Managing downside risk is in our company DNA, and our multi-asset approach aims to help shield portfolios from unpredictable market swings while stabilizing investment returns.

We offer traditional balanced portfolio management alongside multi-asset income solutions that aim to deliver consistent yields and growth. In addition, we believe that we are entering a new era for financial markets that requires a complete rethinking of diversification. That’s why we also offer an innovative, unconstrained “multi-strategy” approach that allocates to investment themes rather than top-down asset classes in order to achieve a total return target.

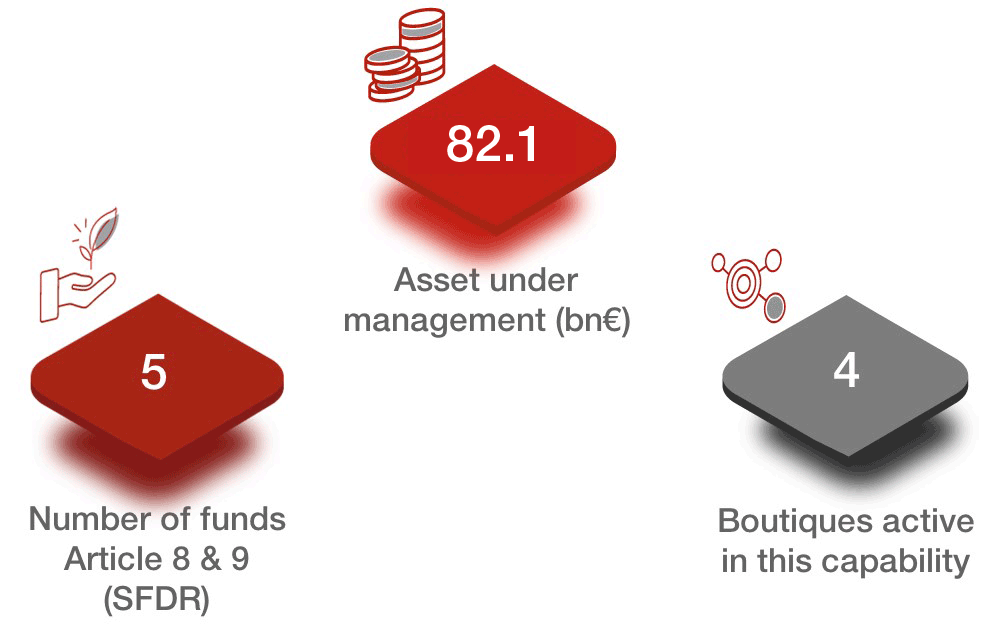

Key data

ast at 31 December 2022